Posts Tagged ‘tax strategy’

January Entity Elections That Save Real Money

January is when the math still has room to move. You’re not scrambling to “clean up” last year.You’re deciding what this year becomes. And for high earners with business income, side income, or multiple pay sources, entity elections are one of the few moves that can change your entire tax outcome. Not because of a…

Read MoreThe Retirement Savings Rate That Actually Works: Tax-Smart Strategies for High Earners

How much should you be saving for retirement? The wrong percentage can derail your long-term goals. A safe, effective savings rate isn’t a guess. It’s based on math, strategy, and smart tax planning. Let’s answer the real questions: What works? What doesn’t? And how can you keep more of what you earn while building wealth?…

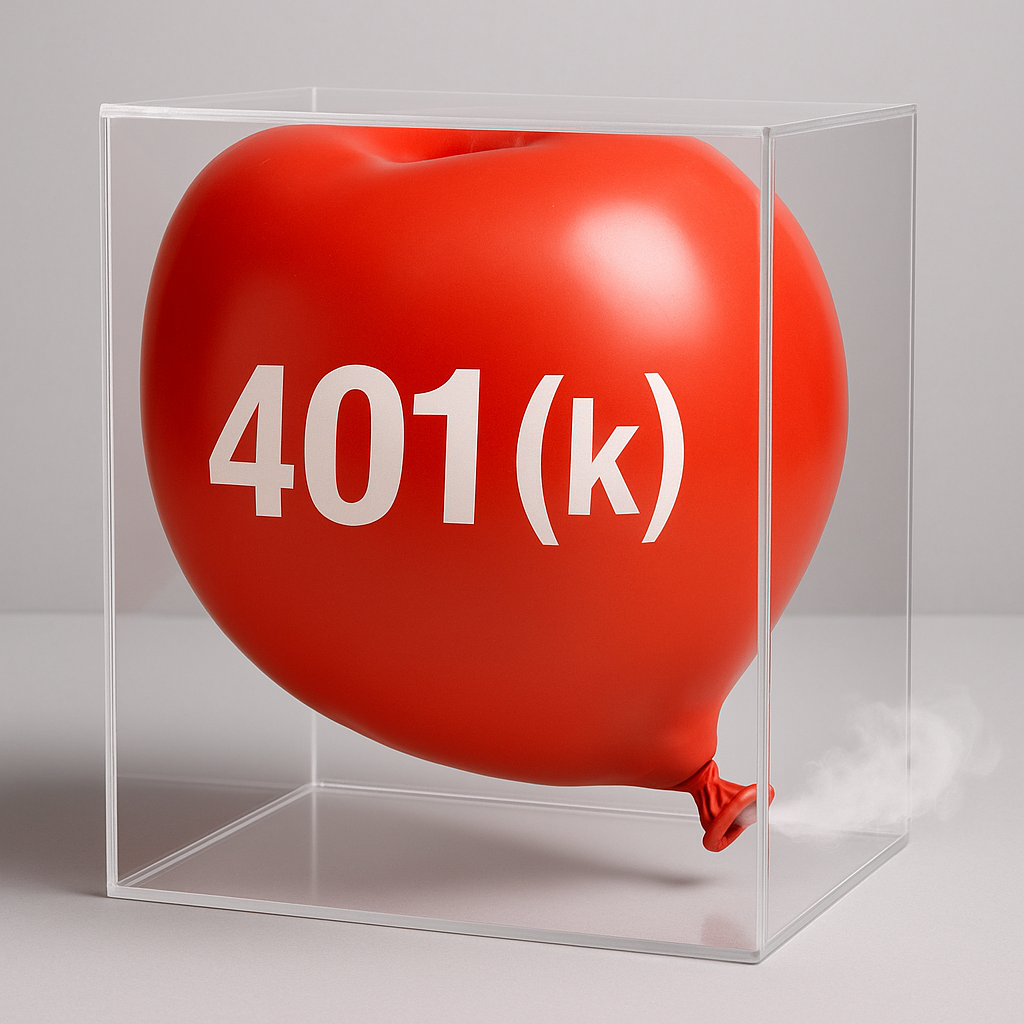

Read MoreWhy Retirement Plans Need Room to Breathe

Most retirement plans are built with one goal: maximize contributions. But what if that mindset is too rigid? What if by trying to optimize every tax-advantaged dollar, you’re setting yourself up for long-term inefficiencies, liquidity problems, or even unnecessary taxes? Retirement plans need room to breathe. You need flexibility—financial, strategic, and tax-related—so your savings can…

Read More