Posts Tagged ‘Tax Savings’

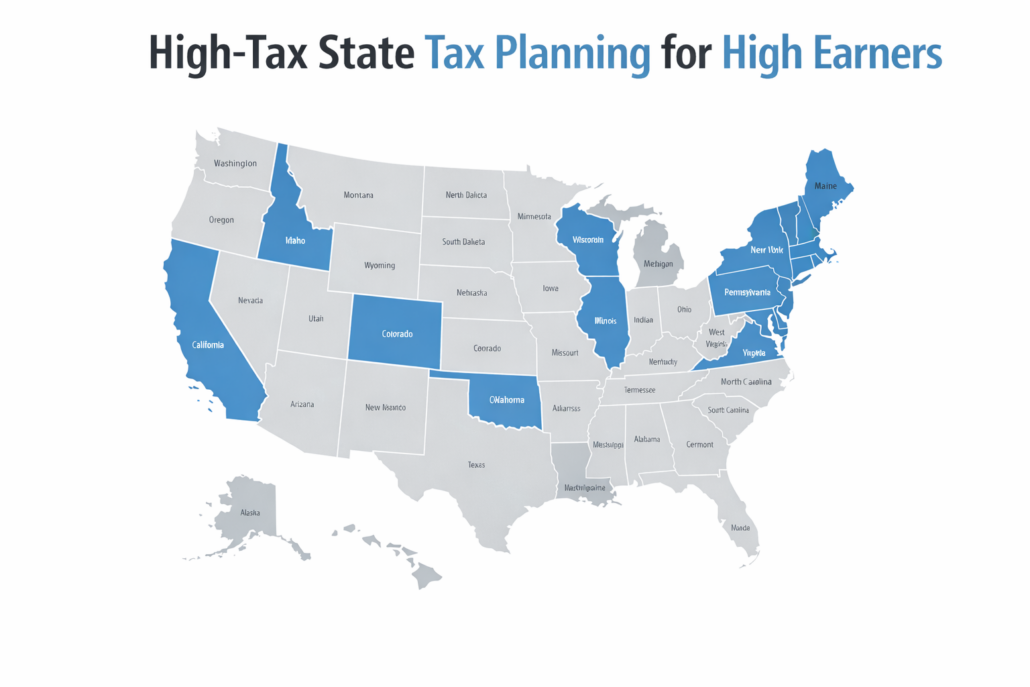

Which Taxpayers in High-Tax States Benefit Most?

If you live in a high-tax state, you’ve probably had this moment. You look at your paycheck.You look at your business profit.You look at your state tax bill. And you think, “Wait. Who is this even for?” High-tax states can feel like a one-way street. You earn more, you pay more, and the math starts…

Read MoreHow Much Do You Need to Make Before Tax Planning Pays Off? (Business Owners Guide)

At some point, you start noticing something. Your income goes up.Your business gets busier.Your bank balance looks fine. And still… your tax bill keeps showing up like an uninvited guest. You might even catch yourself thinking, “Is tax planning only for people who make way more than me?” Or, “Do I really need a tax…

Read MoreAutomate Your Finances Without Losing Control: Guardrails for High Earners

Automation sounds like freedom. Bills paid. Savings handled. Taxes set aside. No scrambling. No late fees. No “where did my money go” moment at the end of the month. But if you’re a high earner, automation can also feel… risky. Because your income might swing. Your taxes might surprise you. Your “normal” month could include…

Read MoreWaiting on a Refund? You Might Be Missing Better Tax Savings Moves

You get to April, you file, and then you wait. And wait. If you’re a high-income earner in medicine, that refund can feel like a small win. A little relief. A moment where you think, I guess I did something right. But here’s the twist. A refund often means you overpaid during the year. The…

Read MoreIs Your Tax Strategy Stuck on Repeat? A Groundhog Day Wake-Up Call for High Earners

If you earn a lot and you run something on the side (or as your main thing), you probably know this feeling. You make good money. Your business grows. Your 1099 income climbs. Then tax season shows up and you think, “Why is this the same stress again?” Same scramble. Same guesswork. Same surprise bill.…

Read MoreTaxes on Investments: A 2025 Guide

Investing grows wealth. But taxes can quietly erode returns if you aren’t careful. In 2025, the rules around investment taxation remain complex, especially for high-income earners and business owners. Understanding how taxes affect your portfolio lets you keep more of your money. With strategic planning, you can reduce tax drag, protect gains, and accelerate your…

Read MoreFinancial Independence Isn’t Just About Earning More—It’s About Keeping More

High earnings feel empowering. But without strategic planning, even substantial income can slip away through taxes, missed deductions, and inefficient structures. Financial independence isn’t solely about how much you earn—it’s about how much you retain. For business owners and high-income earners, tax planning is a key lever. Keeping more money legally allows you to grow…

Read MoreTax Planning for Growing Businesses: Why You Can’t DIY Forever

Running a business is exciting, but growth comes with new challenges. One of the biggest mistakes business owners make is thinking they can handle their taxes alone indefinitely. Tax planning evolves as your business grows, and DIY approaches often leave money on the table. Understanding why professional guidance matters can help you keep more of…

Read MoreThe Retirement Savings Rate That Actually Works: Tax-Smart Strategies for High Earners

How much should you be saving for retirement? The wrong percentage can derail your long-term goals. A safe, effective savings rate isn’t a guess. It’s based on math, strategy, and smart tax planning. Let’s answer the real questions: What works? What doesn’t? And how can you keep more of what you earn while building wealth?…

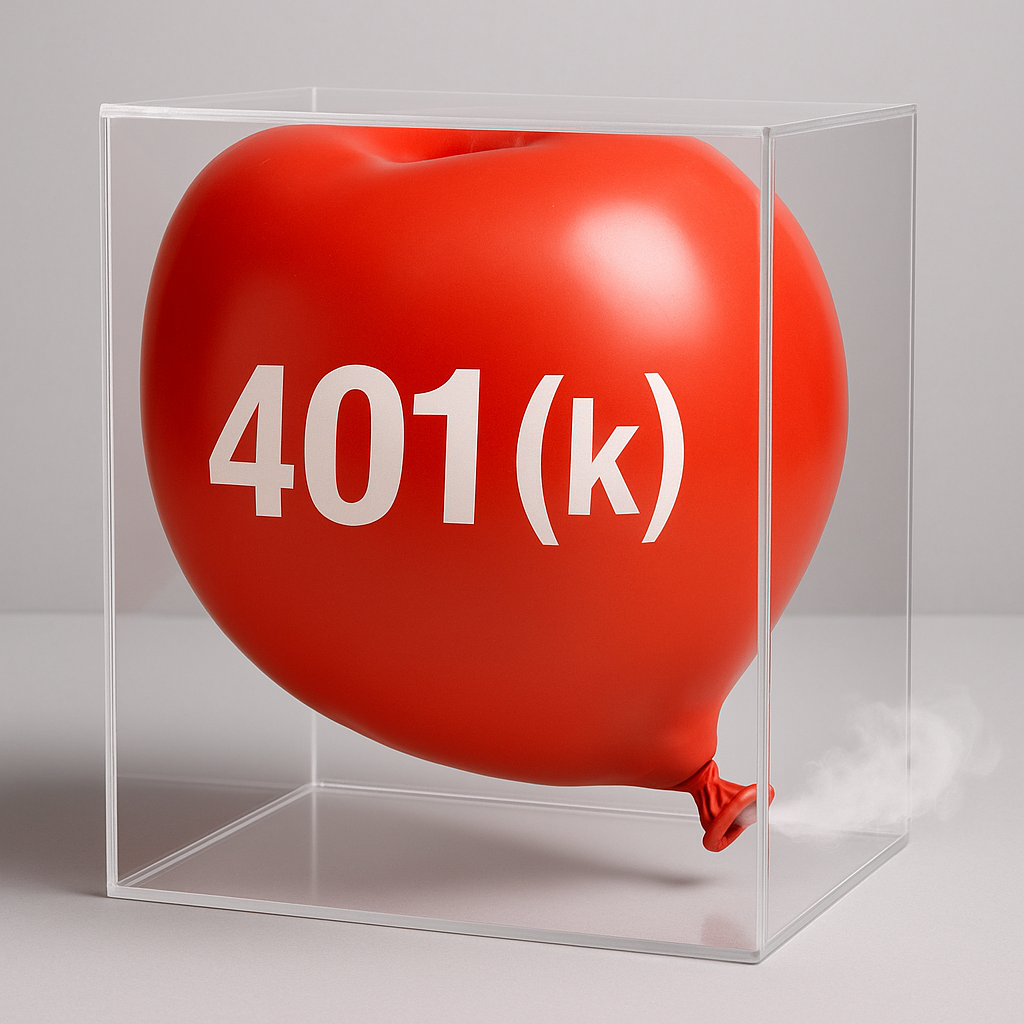

Read MoreWhy Retirement Plans Need Room to Breathe

Most retirement plans are built with one goal: maximize contributions. But what if that mindset is too rigid? What if by trying to optimize every tax-advantaged dollar, you’re setting yourself up for long-term inefficiencies, liquidity problems, or even unnecessary taxes? Retirement plans need room to breathe. You need flexibility—financial, strategic, and tax-related—so your savings can…

Read More