Posts Tagged ‘tax planning’

Safe Harbor Rules: How to Stay Penalty-Free Without Guessing

If you’ve ever tried to “wing it” with estimated taxes, you know the feeling. You have a strong year. Cash hits your account. You think, I’ll sort it out later. Then “later” shows up as a surprise IRS underpayment notice. Not huge. Just annoying. And it feels avoidable, because it usually is. That’s what safe…

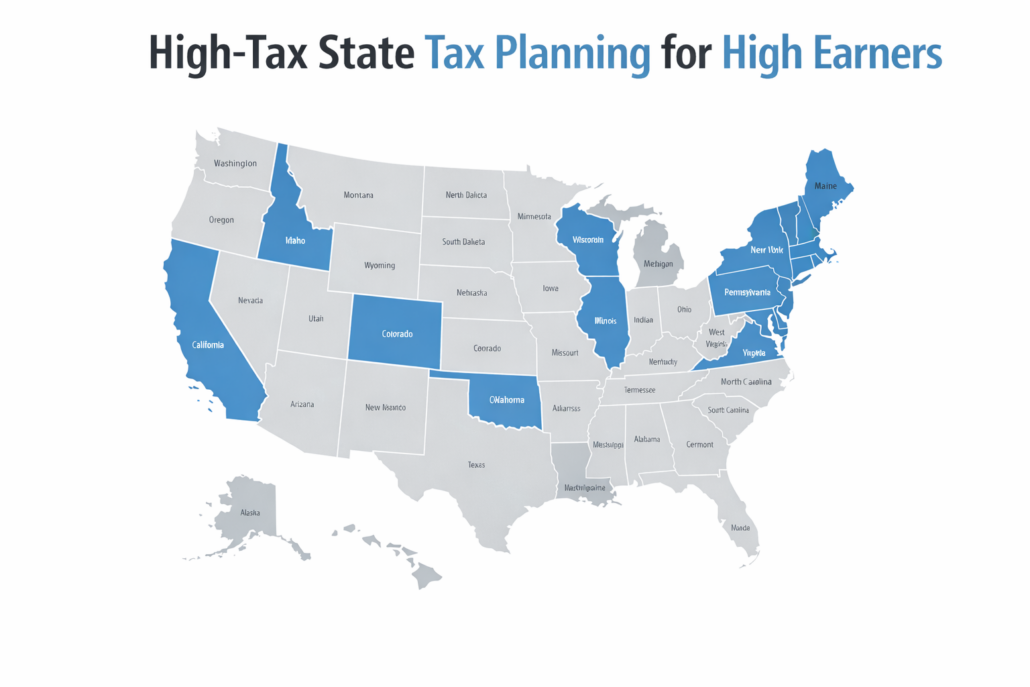

Read MoreWhich Taxpayers in High-Tax States Benefit Most?

If you live in a high-tax state, you’ve probably had this moment. You look at your paycheck.You look at your business profit.You look at your state tax bill. And you think, “Wait. Who is this even for?” High-tax states can feel like a one-way street. You earn more, you pay more, and the math starts…

Read MoreTax Planning vs Tax Preparation Fees: What’s Deductible and What Isn’t (Business + Personal Breakdown)

You pay your CPA. You get the invoice. You glance at the total and think, wait… can I write any of this off? If you’re a high earner, that question comes up a lot. Sometimes you’re paying for straight tax prep. Sometimes it’s tax planning. Sometimes it’s both mixed together, plus bookkeeping, payroll, entity cleanup,…

Read MoreAutomate Your Finances Without Losing Control: Guardrails for High Earners

Automation sounds like freedom. Bills paid. Savings handled. Taxes set aside. No scrambling. No late fees. No “where did my money go” moment at the end of the month. But if you’re a high earner, automation can also feel… risky. Because your income might swing. Your taxes might surprise you. Your “normal” month could include…

Read MoreWaiting on a Refund? You Might Be Missing Better Tax Savings Moves

You get to April, you file, and then you wait. And wait. If you’re a high-income earner in medicine, that refund can feel like a small win. A little relief. A moment where you think, I guess I did something right. But here’s the twist. A refund often means you overpaid during the year. The…

Read MoreIs Your Tax Strategy Stuck on Repeat? A Groundhog Day Wake-Up Call for High Earners

If you earn a lot and you run something on the side (or as your main thing), you probably know this feeling. You make good money. Your business grows. Your 1099 income climbs. Then tax season shows up and you think, “Why is this the same stress again?” Same scramble. Same guesswork. Same surprise bill.…

Read MoreTax Planning vs Tax Filing: The January Fork

January gives you a choice. You can treat taxes like a once-a-year paperwork problem.Or you can treat taxes like a year-long strategy. High earners don’t get crushed by taxes because they “missed a deduction.”They get crushed because they waited too long to build a plan. January is where your tax year splits into two paths.And…

Read MoreWhat Smart High-Income Earners Do in January

January is the month where your money either gets organized… or it quietly drifts into “we’ll deal with it later.”And for high-income earners, “later” usually comes with a bigger tax bill. The smartest people don’t wait for tax season to start thinking about taxes.They treat January like a reset button. Not a motivation speech.A strategy…

Read MoreJanuary Cash-Flow Planning That Reduces Stress

January has this weird mix of energy and pressure. Part of you wants a clean slate. A fresh plan. A calm year. And part of you is thinking… “Okay, but what’s actually hitting my bank account this month?” Because if you’re a high earner, cash flow doesn’t always mean “steady paycheck.”It can mean: A big…

Read MoreTaxes on Investments: A 2025 Guide

Investing grows wealth. But taxes can quietly erode returns if you aren’t careful. In 2025, the rules around investment taxation remain complex, especially for high-income earners and business owners. Understanding how taxes affect your portfolio lets you keep more of your money. With strategic planning, you can reduce tax drag, protect gains, and accelerate your…

Read More