Posts Tagged ‘safe harbor rule’

Safe Harbor Rules: How to Stay Penalty-Free Without Guessing

If you’ve ever tried to “wing it” with estimated taxes, you know the feeling. You have a strong year. Cash hits your account. You think, I’ll sort it out later. Then “later” shows up as a surprise IRS underpayment notice. Not huge. Just annoying. And it feels avoidable, because it usually is. That’s what safe…

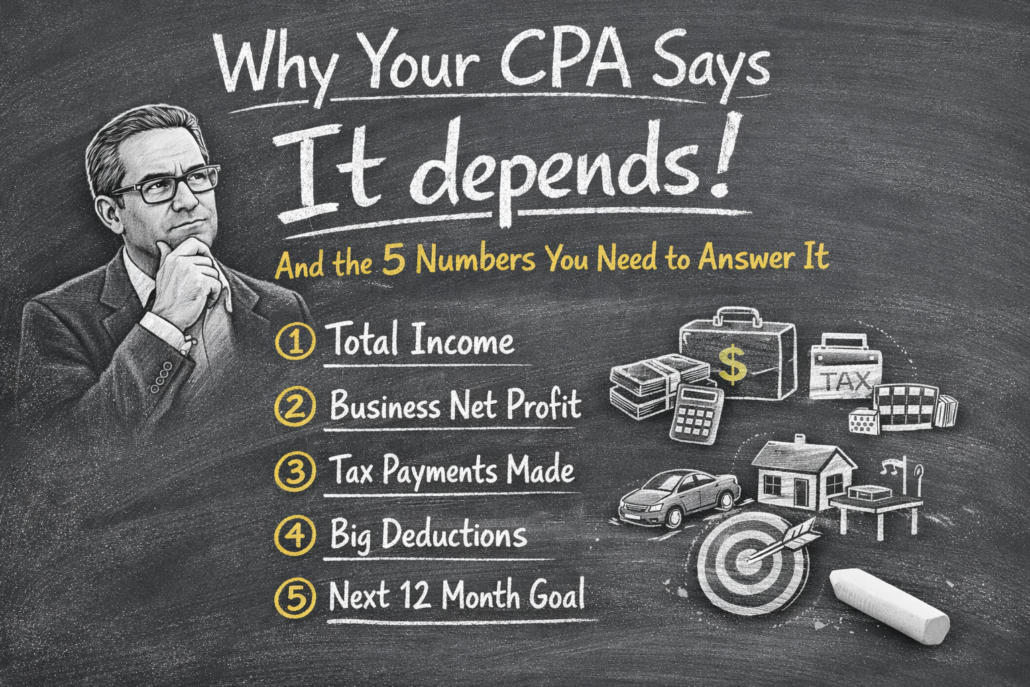

Read MoreWhy Your CPA Says “It Depends” (And the 5 Numbers You Need to Answer It)

You ask a simple question. “Should I switch to an S corp?”“Can I write this off?”“Do I need to pay quarterly taxes?”“Should I do a big retirement contribution?” And your CPA says the line you didn’t want to hear. It depends. If you’ve ever felt mildly annoyed by that answer… you’re not alone. I’ve had…

Read MoreInflation Cooled—So Why Does Your Budget Still Feel Tight? (And What to Do About It in Your Tax Plan)

Inflation cooled. You’ve probably seen the headlines. So why does your budget still feel… cramped? If you’re a high-income earner, it can feel almost annoying. You did the “right” things. You earn well. You work hard. You might even run a business or pick up 1099 income. And yet your monthly cash flow still feels…

Read MoreHow Much Do You Need to Make Before Tax Planning Pays Off? (Business Owners Guide)

At some point, you start noticing something. Your income goes up.Your business gets busier.Your bank balance looks fine. And still… your tax bill keeps showing up like an uninvited guest. You might even catch yourself thinking, “Is tax planning only for people who make way more than me?” Or, “Do I really need a tax…

Read MoreAutomate Your Finances Without Losing Control: Guardrails for High Earners

Automation sounds like freedom. Bills paid. Savings handled. Taxes set aside. No scrambling. No late fees. No “where did my money go” moment at the end of the month. But if you’re a high earner, automation can also feel… risky. Because your income might swing. Your taxes might surprise you. Your “normal” month could include…

Read MoreBuying a Home With Variable Income: How to Set Estimates So You Don’t Blow Your Budget

If your income shows up in waves, buying a home can feel… weirdly stressful. One month you’re flush. The next month you’re waiting on invoices, bonuses, distributions, or a contract renewal that feels like it’s taking forever. And mortgages don’t care. A lender might approve you based on strong numbers. Your bank account might even…

Read MoreA Wild Week on Wall Street: The Tax Planning Moves High Earners Should Make Before the Next Swing

If you watched the market this week and felt your stomach do that little drop thing, you’re not alone. One day it’s green and everyone acts like the future is settled. The next day, a headline hits, the market slides, and suddenly your portfolio looks like it aged five years overnight. It’s weird how fast…

Read MorePhysical Silver vs Silver ETFs: The Tax Differences High Earners Miss

If you’ve ever looked at silver and thought, “Okay, this feels safer than whatever the market is doing this week,” you’re not alone. I’ve had the same thought. Then you start shopping, and suddenly you’re choosing between a stack of physical bars and coins versus a ticker symbol you can buy in two clicks. Both…

Read MoreBitcoin Volatility Isn’t Just Market Noise—It’s a Tax Strategy Window

Bitcoin can feel like whiplash. One week it’s up. The next week it’s down. Sometimes it’s both in the same day. If you’ve ever looked at your crypto account and thought, “Why did I even open this app,” you’re not alone. But here’s the part most high earners miss at first. Volatility isn’t only a…

Read MoreHow January Planning Changes Estimated Taxes

January is when your tax year becomes real. Not in an abstract way. Not in a “we’ll deal with it later” way. In a math way. Because by the time you realize your estimated taxes are off…you’ve already been wrong for months. Most high earners don’t “miss” estimated taxes because they forgot the deadlines. They…

Read More