Posts Tagged ‘estimated taxes’

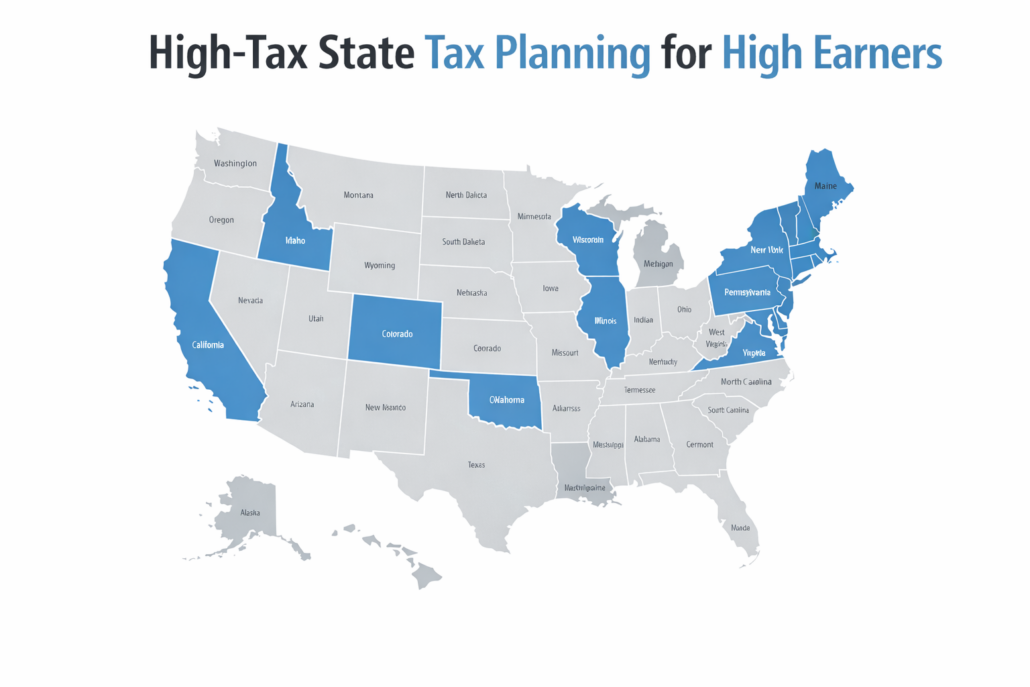

Which Taxpayers in High-Tax States Benefit Most?

If you live in a high-tax state, you’ve probably had this moment. You look at your paycheck.You look at your business profit.You look at your state tax bill. And you think, “Wait. Who is this even for?” High-tax states can feel like a one-way street. You earn more, you pay more, and the math starts…

Read MoreHow Much Do You Need to Make Before Tax Planning Pays Off? (Business Owners Guide)

At some point, you start noticing something. Your income goes up.Your business gets busier.Your bank balance looks fine. And still… your tax bill keeps showing up like an uninvited guest. You might even catch yourself thinking, “Is tax planning only for people who make way more than me?” Or, “Do I really need a tax…

Read MoreBuying a Home With Variable Income: How to Set Estimates So You Don’t Blow Your Budget

If your income shows up in waves, buying a home can feel… weirdly stressful. One month you’re flush. The next month you’re waiting on invoices, bonuses, distributions, or a contract renewal that feels like it’s taking forever. And mortgages don’t care. A lender might approve you based on strong numbers. Your bank account might even…

Read MoreWaiting on a Refund? You Might Be Missing Better Tax Savings Moves

You get to April, you file, and then you wait. And wait. If you’re a high-income earner in medicine, that refund can feel like a small win. A little relief. A moment where you think, I guess I did something right. But here’s the twist. A refund often means you overpaid during the year. The…

Read MoreIs Your Tax Strategy Stuck on Repeat? A Groundhog Day Wake-Up Call for High Earners

If you earn a lot and you run something on the side (or as your main thing), you probably know this feeling. You make good money. Your business grows. Your 1099 income climbs. Then tax season shows up and you think, “Why is this the same stress again?” Same scramble. Same guesswork. Same surprise bill.…

Read MoreQ1 Tax Planning: Why January Sets the Tone

January has an energy no other month can match. The slate is clean, decisions feel sharper, and you can finally see the shape of the year you want to build. For high-income earners, this isn’t just motivational—it’s financial. The moves you make right now quietly set the tone for your entire Q1 tax position, long…

Read MoreJanuary Planning for Control-Focused Business Owners

You don’t become a high-income business owner by “hoping things work out.”You built your income on decisions.Systems.Execution. So when January hits, you’re not chasing motivation. You’re chasing control. Because if you wait until tax season to look at your numbers, you’re already behind.Not because you did anything “wrong.”But because the game changed and you didn’t…

Read MoreJanuary Entity Elections That Save Real Money

January is when the math still has room to move. You’re not scrambling to “clean up” last year.You’re deciding what this year becomes. And for high earners with business income, side income, or multiple pay sources, entity elections are one of the few moves that can change your entire tax outcome. Not because of a…

Read MoreTax Planning vs Tax Filing: The January Fork

January gives you a choice. You can treat taxes like a once-a-year paperwork problem.Or you can treat taxes like a year-long strategy. High earners don’t get crushed by taxes because they “missed a deduction.”They get crushed because they waited too long to build a plan. January is where your tax year splits into two paths.And…

Read MoreWhat Smart High-Income Earners Do in January

January is the month where your money either gets organized… or it quietly drifts into “we’ll deal with it later.”And for high-income earners, “later” usually comes with a bigger tax bill. The smartest people don’t wait for tax season to start thinking about taxes.They treat January like a reset button. Not a motivation speech.A strategy…

Read More