Preparing for Tax Change: Tax Law Updates and Tax Planning Tips for Physicians in 2024-2026

Preparing for Tax Change: Tax Law Updates and Tax Planning Tips for Physicians in 2024 2026 In an ever-evolving tax landscape, it’s crucial to understand the upcoming changes and how they could impact your financial health. This comprehensive session will cover: 2024-2026 Tax Law Changes: Gain insights into the latest tax legislation and understand what…

Read MoreAccounting Basics for Business Owners

Understanding accounting basics is essential for any business owner. You’ve poured your passion, time, and energy into building your business. Amidst the hustle and bustle, have you ever paused to consider the pivotal role accounting plays in shaping your business’s success? Accounting isn’t just a task to check off; it’s a crucial compass guiding your…

Read MoreCorporations: Unlocking the Potential of S and C Corps

For business owners seeking to optimize their tax planning strategies, unlocking the potential of corporations is essential. Navigating the intricate landscape of business entities and taxation requires a keen understanding of the various structures available to entrepreneurs. In this comprehensive guide, we delve into the nuanced world of C-Corps and S-Corps, exploring their benefits, drawbacks,…

Read MoreCommon Tax Mistakes to Avoid this Filing Season

As a high-income business owner, navigating the complexities of tax planning is essential to ensure your financial success. Filing your taxes accurately holds immense significance, serving as the cornerstone of your financial stability and business integrity. It’s not just about meeting legal requirements; it’s about optimizing your tax strategy to minimize liabilities and maximize savings.…

Read MoreFinancial Recordkeeping Essentials for Smooth Taxes

Is the chaos of tax season getting to you because your financial recordkeeping is in disarray? You’re not alone; the majority of Americans share the stress, with 40% citing information gathering as the most daunting part. But fear not! We can show you how to approach financial recordkeeping for seamless tax filing. By implementing effective…

Read MoreNavigating the Changes 2024 Tax Updates

Tax Strategies for Small Business Owners: Preparing for Year-End and Quarterly Payments

Small business owners must fulfill specific tax requirements, but with the hectic nature of day-to-day operations, focusing on actionable tax strategies often gets pushed to the side. As a small business owner, your plate is always full, meaning that tax planning is often the furthest thing from your mind. However, a lack of tax strategies…

Read MorePlanning your Dream Retirement: A Guide for Individuals

Retirement planning is crucial to achieving a secure, fulfilling post-work life. Having a clear vision of your retirement goals and identifying effective strategies to meet these goals can ensure financial stability so you can enter retirement without worrying about your financial future. However, finding the best retirement strategies to guarantee stability is challenging for many…

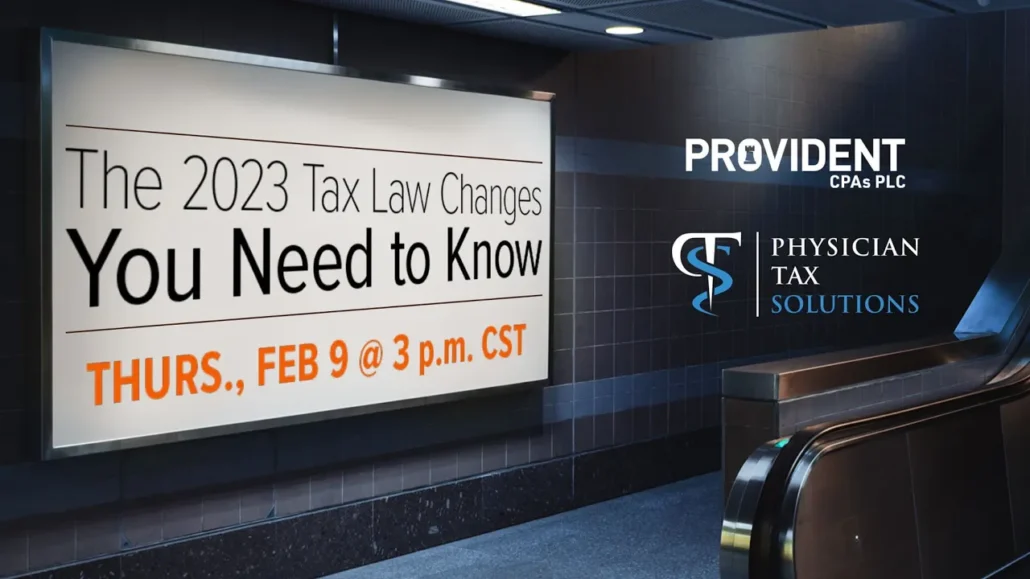

Read MoreWebinar – The 2023 Tax Law Changes You Need to Know

How to Hire Your Business’s First Employee

As a business owner, getting extra help is a crucial step towards growth. Here’s what you need to do when hiring your first employee. Key takeaways: Decide between a regular employee vs. contractor Get tax ID numbers Register with the labor department Gather the right forms Set up a payroll system Create a benefits strategy…

Read More