Safe Harbor Rules: How to Stay Penalty-Free Without Guessing

If you’ve ever tried to “wing it” with estimated taxes, you know the feeling. You have a strong year. Cash hits your account. You think, I’ll sort it out later. Then “later” shows up as a surprise IRS underpayment notice. Not huge. Just annoying. And it feels avoidable, because it usually is. That’s what safe…

Read MoreWhy Your CPA Says “It Depends” (And the 5 Numbers You Need to Answer It)

You ask a simple question. “Should I switch to an S corp?”“Can I write this off?”“Do I need to pay quarterly taxes?”“Should I do a big retirement contribution?” And your CPA says the line you didn’t want to hear. It depends. If you’ve ever felt mildly annoyed by that answer… you’re not alone. I’ve had…

Read MoreEstate Tax Planning in 2026: New Exclusion, Old Mistakes

You can earn a lot, save a lot, invest a lot, and still leave a mess behind. Not because you did anything reckless. Because estate planning feels like something you “get to later.” Then later shows up. Here’s the simple version of what’s changing in 2026. The federal estate and gift tax exclusion is $15,000,000…

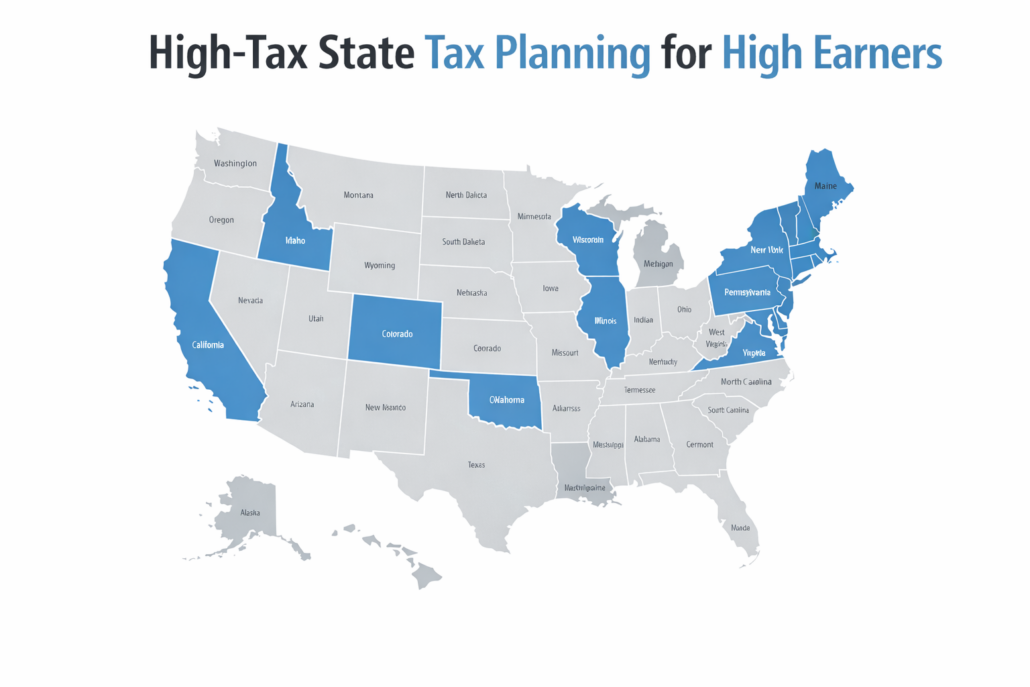

Read MoreWhich Taxpayers in High-Tax States Benefit Most?

If you live in a high-tax state, you’ve probably had this moment. You look at your paycheck.You look at your business profit.You look at your state tax bill. And you think, “Wait. Who is this even for?” High-tax states can feel like a one-way street. You earn more, you pay more, and the math starts…

Read MoreSALT Cap Rules Right Now: Who Actually Benefits and Who Doesn’t

A few years ago, “SALT cap” became one of those phrases people tossed around at dinner like everyone knew what it meant. Most people didn’t. They still don’t. And honestly, that’s fair. It’s a wonky rule that only matters when it matters. Which is usually: you live in a higher-tax state you own a home…

Read MoreWhy You Need a Tax Advisor, Not Just a Tax Preparer

You probably know this feeling. It’s late March or early April. You finally gather your documents. You send them over. Your tax person files the return. You sign. You pay. You move on. And then, a week later, you wonder: Did I just do taxes… or did I actually plan anything? That’s the difference. A…

Read MoreRoth vs Pre-Tax for High Earners: How to Decide Without Guessing

You can make a lot of money and still feel unsure about one basic question. Should you put retirement dollars into Roth or pre-tax? It sounds like a simple choice. It isn’t. Because the “best” answer depends on what you earn now, how you earn it, what you can deduct, and what your future tax…

Read MoreTax Planning vs Tax Preparation Fees: What’s Deductible and What Isn’t (Business + Personal Breakdown)

You pay your CPA. You get the invoice. You glance at the total and think, wait… can I write any of this off? If you’re a high earner, that question comes up a lot. Sometimes you’re paying for straight tax prep. Sometimes it’s tax planning. Sometimes it’s both mixed together, plus bookkeeping, payroll, entity cleanup,…

Read MoreInflation Cooled—So Why Does Your Budget Still Feel Tight? (And What to Do About It in Your Tax Plan)

Inflation cooled. You’ve probably seen the headlines. So why does your budget still feel… cramped? If you’re a high-income earner, it can feel almost annoying. You did the “right” things. You earn well. You work hard. You might even run a business or pick up 1099 income. And yet your monthly cash flow still feels…

Read MoreHow Much Do You Need to Make Before Tax Planning Pays Off? (Business Owners Guide)

At some point, you start noticing something. Your income goes up.Your business gets busier.Your bank balance looks fine. And still… your tax bill keeps showing up like an uninvited guest. You might even catch yourself thinking, “Is tax planning only for people who make way more than me?” Or, “Do I really need a tax…

Read More